Bilibili Inc. (NASDAQ:BILI) Financial Performance Overview

By Tredu.com • 2025-08-21 13:00:03

Tredu

- Bilibili reported an EPS of $0.18, surpassing the estimated $0.17, indicating a positive surprise for investors.

- The company's revenue of approximately $1.02 billion fell short of the estimated $7.33 billion, highlighting a significant gap in anticipated sales performance.

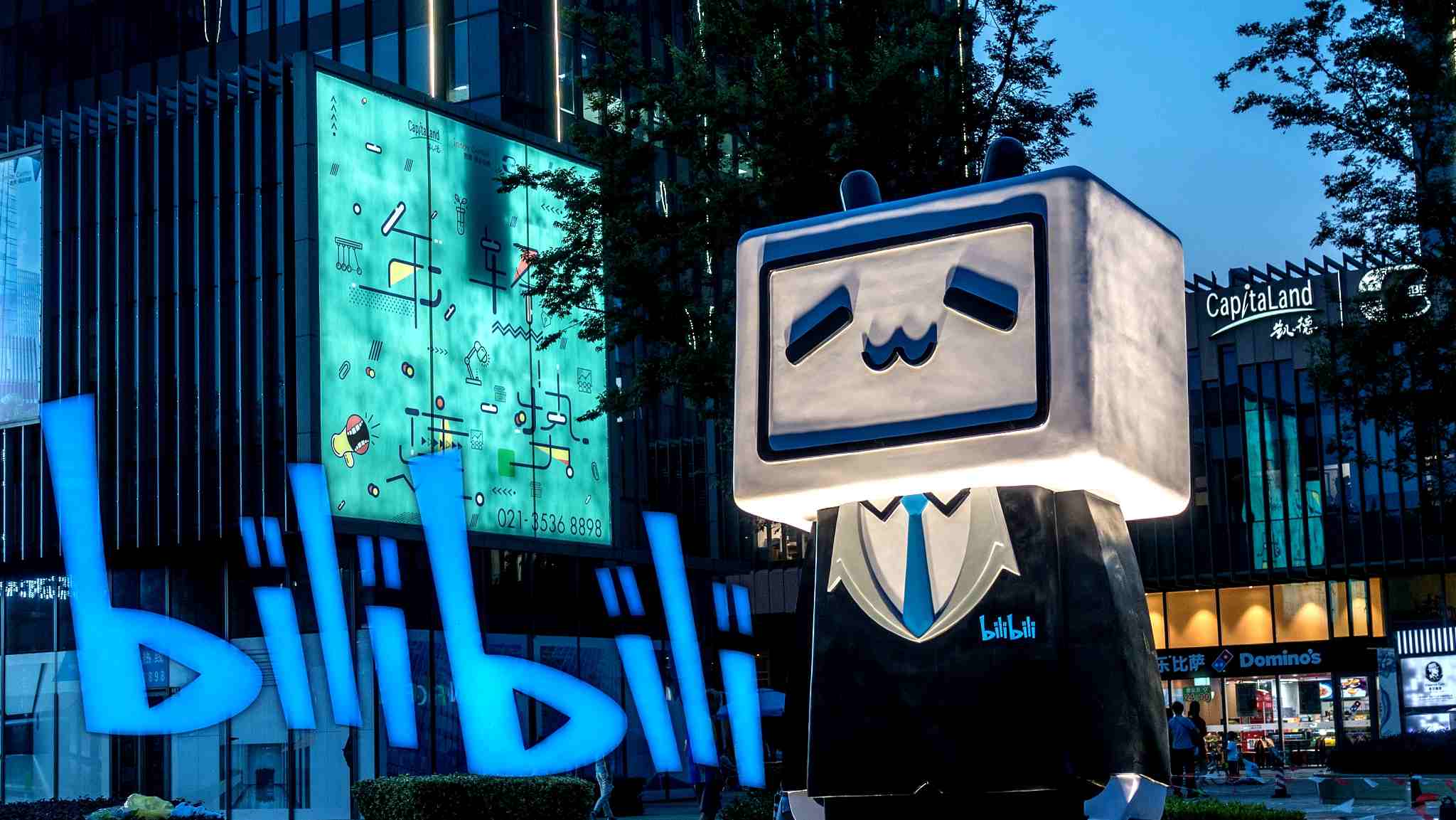

Bilibili Inc. (NASDAQ:BILI) is a leading video community platform in China, catering primarily to young audiences. The company is listed on both the Nasdaq and the Hong Kong Stock Exchange, and it has established itself as a significant player in the digital entertainment sector. Bilibili's financial performance is closely watched by investors, given its influence in the market.

On August 21, 2025, Bilibili reported earnings per share (EPS) of $0.18, slightly above the estimated $0.17. This indicates a positive surprise for investors, as the company managed to exceed expectations. However, the revenue of approximately $1.02 billion fell short of the estimated $7.33 billion, highlighting a significant gap in anticipated sales performance.

Bilibili's price-to-sales ratio is about 2.69, showing that investors are willing to pay $2.69 for every dollar of sales. The enterprise value to sales ratio is slightly lower at 2.54, reflecting the company's valuation, including its debt. This suggests that while the company is valued for its sales potential, its debt is a factor in its overall valuation.

The company's debt-to-equity ratio is approximately 0.37, indicating a moderate level of debt compared to its equity. This suggests that Bilibili is managing its debt levels reasonably well. Additionally, the current ratio of about 1.36 shows that the company has enough liquidity to cover its short-term liabilities, providing some financial stability amidst its earnings challenges.