By Tredu.com

• Tredu

Understanding Cryptocurrency Market Volatility

5/13/2025

You’ve probably seen headlines like “Bitcoin crashes overnight” or “Crypto surges 30% in a day.”

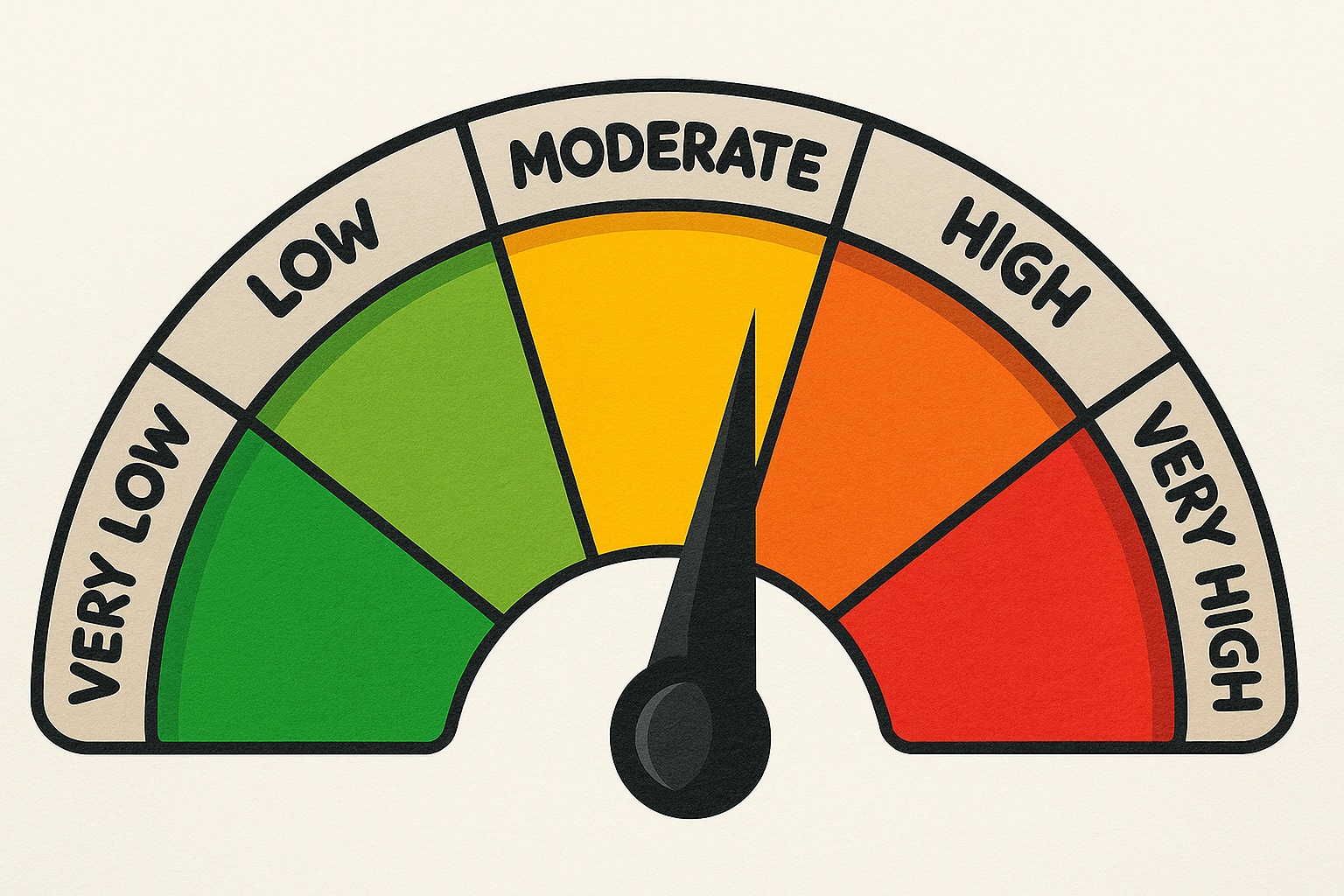

Wild price swings are nothing new in the crypto world. This up-and-down behavior is what people refer to as cryptocurrency volatility. While it may seem unpredictable, there are actual reasons behind these moves—and if you understand them, you can handle them a lot better.

Whether you’re trading daily or just holding coins for the long term, learning to manage this volatility is key.

Why Are Crypto Prices So Unstable?

Cryptocurrencies are still in their early stages compared to other markets like stocks or forex. They haven’t fully matured, and as a result, their prices often respond to even small events. A single tweet or government policy update can cause prices to rise or fall within minutes.

There are a few reasons behind this kind of behavior:

- Speculation: Many people buy digital assets expecting quick profits. That creates rapid price action based on hype, not value.

- Low liquidity: Some coins don’t have enough daily trading volume, so large trades have a big impact on price.

- Market sentiment: Emotions run high in crypto. Fear and excitement move the market more than facts sometimes.

- Regulatory uncertainty: Governments are still figuring out how to deal with cryptocurrencies, and any news on this front can shake up the market.

Making Sense of Market Swings With Crypto Market Analysis

To deal with this environment, you need a strong understanding of crypto market analysis. That doesn’t mean you need to become a technical analyst overnight, but knowing what to look for can really help.

There are two basic approaches:

1. Technical analysis

This method focuses on price charts, volume trends, and indicators like moving averages or RSI. It’s especially useful in volatile markets where quick decisions matter.

2. Fundamental analysis

Instead of charts, this method looks at the actual project behind a coin. Is there a real team? A working product? Demand for the technology?

When you combine these two methods, you get a clearer picture of what’s really going on with a coin’s price—and whether it’s worth your attention.

Volatility Isn’t Just Risk—It’s Opportunity

Here’s something important: cryptocurrency volatility isn’t always a bad thing. In fact, many traders rely on these price swings to profit. The key is knowing how to respond without letting emotions take over.

Short-term traders can take advantage of daily or even hourly movements. Long-term investors, on the other hand, often view sudden drops as a chance to buy more at a discount.

But either way, discipline matters. Entering and exiting trades blindly just because a coin is “going up fast” is a mistake many new traders make.

Digital Currency Trading Strategies for a Volatile Market

A fast-moving market calls for thoughtful planning. Here are some digital currency trading strategies that can help you stay grounded when things get wild:

- Always set a stop-loss: Don’t wait until things get worse. Decide in advance how much you’re willing to lose on a trade.

- Take profits regularly: If a coin is up 50%, it’s okay to take some profits off the table. You don’t have to hold forever.

- Avoid going all in: Spread your investments across different coins. That way, a drop in one won’t ruin your entire portfolio.

- Watch the news, but don’t panic: Headlines can be dramatic. Keep an eye on what’s happening, but don’t make decisions in fear.

These small adjustments in how you trade can make a huge difference.

Are You Trading or Investing?

Before you jump into crypto, it’s good to be clear about your goal.

- Trading means looking for short-term price movements. You’ll need to pay close attention to the market and adjust your strategy often.

- Investing means holding your assets for months or years, believing in their long-term value.

Both approaches are fine—but mixing them can lead to confusion and poor decisions.

Tredu.com Can Help You Learn to Handle the Volatility

At Tredu.com, we believe that the more you know, the better decisions you’ll make. That’s why we’ve created resources to help beginners and experienced traders alike understand and work with market volatility.

You’ll find:

- Lessons on crypto market analysis

- Strategy guides focused on digital currency trading

- Tips for managing cryptocurrency volatility without the stress

We don’t overcomplicate things. We explain what matters in a way that makes sense.

Final Thoughts

Yes, crypto can be unpredictable. But that doesn’t mean it’s unmanageable. With a solid understanding of how volatility works, a smart trading strategy, and the right mindset, you can turn uncertainty into opportunity.

Take your time. Learn the market. And don’t let the headlines shake your confidence.

Tredu is here to help you stay steady; even when the market isn’t.

Other Recent Posts

Why Quality Trading Education Matters: How Verified Trading Educators Boost Your Financial Knowledge

By Tredu.com · 7/14/2025

From Beginner to Pro: Learn How to Trade with the Right Trading Educators by Your Side

By Tredu.com · 7/2/2025

Mastering Risk Management in Forex Trading: What Every Trader Must Know

By Tredu.com · 6/10/2025